The term “off-plan” is certainly not alien to smart investors in the real estate industry, especially those with interest in the Lagos and Abuja markets. How are the rich getting even richer? Do you ever wonder how they are making so much money without commensurate stress? You might have heard it said that real estate is the cornerstone of wealth. One of the secrets of the wealthy in major cities in Nigeria is knowing how to work the opportunities they spot to their advantage. And off-plan estate buyers consistently rake in millions as profits within a short period of property appreciation – massive enough to afford them plots of land in other parts of town, flashy cars, expensive trips and even other pricey investments.

An off-plan property (also known as a pre-sale property, a pre-sale or a pre-construction) is a property you buy below the market value, when it is still undergoing development or construction. During the infancy of a real estate project, developers tend to reduce the cost of properties, offering early adopters a great opportunity for gain. Most investors would even want to monitor the projects they are keying into while making their payments by installments, to ensure that building and finishing materials are of Grade A quality and that the blueprint is carefully followed. At this stage, they can also influence the design and style of their choice houses. Only off-plan deals can give clients room for such flexibility.

Buying pre-constructions is about the cleverest way to put money into real estate, as an off-plan property you acquire for ₦35M could eventually sell for ₦50M on completion. Take a moment to consider these investors: Investor A and Investor B both have ₦50M to put into real estate. Investor A gets informed about a newly rising estate in a well sought-out location, with multiple housing units each of which the developer is willing to sell for ₦35M at the stage of development. Investor A quickly seizes the opportunity, keys into the project, and saves ₦15M off his initial budget of ₦50M, while still having the option to gradually pay certain percentages of the ₦35M over a stipulated period for the property. On the other hand, Investor B goes looking for a completely built or developed property and succeeds in getting one for ₦50M, with the condition that he has to pay the total price of the property at once. Being able to afford it, Investor B acquires the property but later finds out that the housing unit or building which Investor A had purchased for ₦35M is similar to the one he bought at ₦50M. What if Investor B also later discovers some building defects in the fully developed property he just acquired? That would mean that he, after spending an extra ₦15M for a property he could have afforded with ₦35M, also incurs additional cost of repair or maintenance of his defective property. Investor A obviously would have more cash flow, the financial capacity for more investments and profits, and less maintenance fees to worry about than his counterpart, who did not even have the opportunity to ascertain the quality of the materials used in constructing his choice property. This is a typical illustration of the difference between someone who understands the potential of off-plan properties and someone who doesn’t. Indeed, when considering what kind of property to buy with certainty about value and huge profitability, the best decision to make as a shrewd investor is to secure an off-plan property deal and monitor the advancement of the project. Provided this sort of real estate investment is undertaken with a developer who has a reputable history and culture of excellence, it is certainly a meaningful venture.

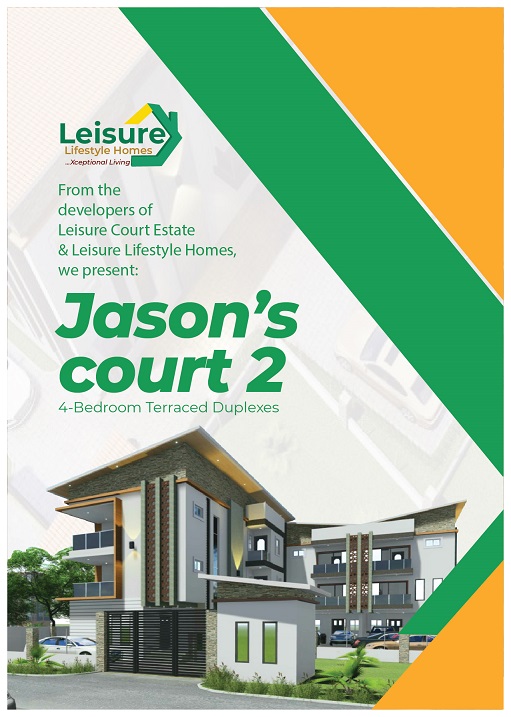

Leisure Court Limited, the developer of Leisure Court Estates & Leisure Lifestyle Homes have their uniqueness in the home market: at the inception of each estate development and off-plan marketing, the company presents a clearly detailed prototype of the estate to buyers, including 3D diagrams, site overviews, site plans, unit plans, and floor plans. The word “prototype” refers to the original sample of the building on paper, which shows the view and vista of both the structure and the environment. The amazing reality is the excellence with which they reproduce prototypes! It goes without saying that their off-plan strategy is rather a goodwill to both investors and householders, not at all an elixir to property development financing.

The Leisure Court Limited’s off-plan sales strategy is a long-term purchase plan which allows investors the chance to make capital gains from their investments by paying for their choice property within a period of 18 months. The payment terms stipulate only 20% of the price of a property as the initial deposit. For instance, if the price of a unit of luxury 2-bedroom apartment in a competitive location in the city is 45 Million Naira (₦45,000,000), the periodic and convenient off-plan payment system requires an early investor to pay only Nine Million Naira (₦9,000,000) as a subscription amount, which is 20% of the price of the property. The balance is spread for one and a half years in this manner: the buyer would pay 20% of the total price after six months, 20% after another six months, and then 40% on completion. This is to the benefit of the buyer, because once there is a signed agreement and a contract of sale, the terms of purchase cannot be compromised by the seller or developer even if the market rises within the period of off-plan purchase. When planning to buy off-plan property, an investor needs to carry out due diligence to guarantee the worthiness of the estate they intend subscribing for. As much as it is certain that a property will appreciate in value with time, there is also a possibility for a market to fall. This is particularly the case when property locations are not well researched to ensure that investors get a huge return on their investments. Location is a major stimulus for choosing an off-plan property, properties do not appreciate at the same level in different communities. For this reason, when purchasing off-plan properties with the aim of making huge returns, the major concern of an astute buyer should be selecting the ones sited in prime locations (and this is ascertained through the landmark facilities within close proximity to it, such as schools, banks, event centres, government offices and agencies, private corporations, parks, and so on; basic infrastructures in the neighborhood of the estate such as airports, seaports, access road into the estate, waste disposal systems, water purification plants, electric utility facilities, etc.; history of the place which tells whether the environment is notable for peace or violence, and several other markers). A property standing in a good location will always rise in value in the real estate market. So, location should be well ahead considered by an investor, while also checking other factors such as the reputation of the developer, trust, and conformity of construction to standard practices.

Leisure Court Limited is reputable for situating impressive estates in exceptionally strategic locations among which are Airport Road, Lugbe and Dakibiyu in Abuja; Alaka (near Eric Moore Towers, National Theatre and National Stadium Surulere), and Lekki (in the neighborhood of Sky Fall, Lekkki Conservation Centre, Elegushi Beach) in Lagos, with more estates springing up. Because of the high potential of these estates to skyrocket return on investment, there is a torrential demand for them as we have witnessed in both Lagos and Abuja. The quality of the residential developments the company has under way is gaining renowned accolades all over major cities, and raining profits for a wide spectrum of investors within and outside the country. Notable among its achievements is that, without compromising building codes and the standards of materials, the Leisure Court Limited is at the middle point of the realty market, satisfying both high-end buyers and middle-class buyers. The company has thus far stood out and weathered every storm in the industry, having provided a system that has proven to be a reliable investment vehicle to many Nigerians, and above all, having never engaged in any substandard or questionable practices which could undermine its accomplishments of many years.

With a verifiable history, good reputation, and many years of success in the industry, the Leisure Court Limited has the answer to every investor’s need. Buildings are developed in estate communities with gates and perimeter fencing, street lights, good drainage, constant electricity, and recreational facilities and security. Apartments fully fitted with AC, heat extractors, microwave ovens, gas cookers, refrigerators, DSTV dual connections, washing machines, and kitchen cabinets. With these properties strategically located, the appreciation in value will surely be on a geometrically progressive level. Who doesn’t want a house whose value multiplies on a daily basis? Upon payment of only 20% of the property’s price as initial deposit, you are offered a contract of sale that is quite lucid and devoid of loopholes, with legal protection well enunciated and all aspects of documentation taken care of at zero cost to the buyer. And given a flexible payment plan that guarantees your “breathing space” in about 18 months, you can secure the best properties in the major cities, courtesy of the Leisure Court Limited. What a joy and convenience it is to embrace this enriching approach to real estate investment. Buying off-plan properties is a millionaire’s investment strategy. You can access housing funds by joining the Leisure Court Multipurpose Cooperative Society. Remember: you will never go wrong with the right association.

Pingback: Ibeju Lekki: Lagos hottest real estate investment location – Leisure Court