TECHNOLOGY AND THE REAL ESTATE INDUSTRY

Technology has no doubt revolutionized every industry in the world. Real estate has been no different. The role of technology in real estate in the last few years has dramatically changed the shape of the industry. The real estate industry is one of the significant profit-generating industries worldwide. A significant chunk of revenue in Nigeria depends on the country’s real estate and construction industry. The industry has been changing fast with technology; real estate is no longer the same as decades before, slowly being redefined by ever-changing market conditions and shifts in consumer behaviors.

FACT: The real estate industry will not be replaced by a single technological solution, but rather the changes in the industry will be enabled by technology and the leaders will be those that embrace it.

The Nigerian real estate industry continues to expand as investor appetite grows alongside the customer base. While this is happening, change is inevitable for any real estate company that wants to remain competitive. The shift towards real estate technology cannot be ignored anymore. As the industry evolves, individual companies will fight to become undisputed leaders by offering solutions such as renewable energy and smart homes that are beyond real estate products and services, in order to have a tight grip on customer loyalty. As technology and innovation continue to shape the real estate industry, tech companies are creating an opportunity to become leaders in the new digital real estate ecosystem. Some of the key areas to focus on for Nigeria real estate companies are highlighted below:

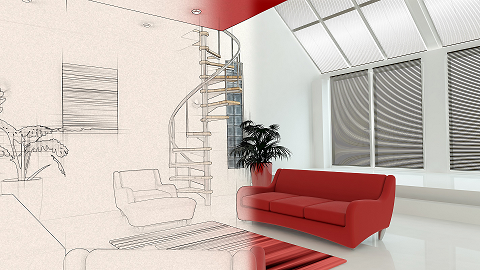

VIRTUAL REALITY

Virtual reality, popularly known as VR technology, has proven to be a game-changer. The role of technology in real estate has been dramatically changed with VR Technology. Staging 3D virtual tours help get rid of the problems like buyers can virtually visit the property without going out of the house. VR has become the trendy choice as it helps to sell property developments both off-plan and finished. Through the power of virtual reality, they allow prospective buyers to walk through and experience the space even before construction has started. Virtual Reality has saved site visits, and people can buy houses or apartments without moving from their coach.

BIG DATA

From driving business decisions to creating better consumer experiences, big data can have a lot of influence on your business. Many real estate businesses collect a lot of data that sit in silo repositories without any analytics being done to pick out industry trends or behaviors of their consumers. Real estate companies wanting to target the right clients need to know who they are when they want to buy, where they are, and how they can reach them in the most effective manner. Harnessing big data is an invaluable tool in targeting the right buyers and an important element in refining the real estate process.

INTERNET OF THINGS

The Internet of Things (IoT) is a key component of home automation and smart homes. This involves automating the ability to control items around the house from curtains to electricity with a hand-held device or voice command. Smart home technology has started changing the way homeowners view a property. It is becoming a game changer for real estate developers in Nigeria. Instead of selling a shell for a house, developers are enticing buyers with internet-ready homes.

BUILDING TECHNOLOGY

With the increased demand for residential affordable housing with less impact on the environment, most real estate developers in Nigeria are left with no choice but to consider innovative ways of building houses. The areas of focus include using prefab building materials and modular construction where a building is constructed offsite and then assembled onsite.

WAYS IN WHICH ONE CAN EMBRACE TECHNOLOGY

- Be intentional about Investing in technologies that make it easier for your potential investors to make decisions about which of your properties to invest in e.g. Real Estate Simulators as well as those that differentiate your properties from the traditional four-wall houses such as Smart Home solutions.

- As you collect more data, invest in business analytics that will pick out trends in your consumer behavior. This in return enables you to target the client with the right products and services and reduce marketing efforts to the wrong market segment.

- Embrace the use of CRM; CRM stands for Customer Relationship Management software. Technology provides an online database system to manage contact information and let you enter the data smoothly without any flaws. CRM has become a popular tool for over a few years for its efficiency in tracking and generating leads. With CRM, leads are easily moved to the sale funnel and tracked down. Several CRM software available in the market and new technology has made them more convenient and successful.

IN CONCLUSION

As the real estate industry evolves, it is certain that the industry is headed for a revolution. Technology will not necessarily disrupt the industry but will disrupt those companies that refuse to embrace the change. Investing in technology as a real estate company is a key differentiator moving forward and that is the reason Leisure Court Limited keenly looks at using technology to differentiate the various offerings amongst other real estate companies.